Investing in Shares "For the Sake of Dividends" - Does it make sense?

In a volatile market such as now, should one invest in a stock for the dividend it pays?Conventional wisdom suggests one should. In a market downtrend, buying stocks of companies with a high dividend yield is considered a good defensive strategy. Dividend yield, which is dividend per share as a percentage of the market price, is a “value” measure that allows one to buy stocks that are only temporarily out of favor, or perhaps under-priced. Generally, the dividend yield strategy outperforms when the market recovers from the bottom.

In sudden sharp corrections, one may be able to pick up a stock that has a high dividend yield and gain once the market recovers. But timing the bottom of a correction is not easy. And in the interim the share price may fall further causing temporary capital erosion. But in the long run, Dividend Yield Stocks deliver capital appreciation along with healthy tax free dividends.

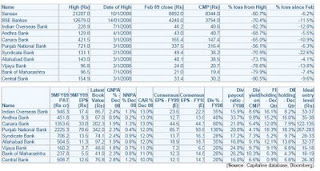

In the current Indian context, banking stocks seem to be one such area that could in the medium term offer the dual benefit of a decent dividend yield (current income) and potential capital appreciation. The BSE Bankex has fallen 70% from its high of 12,679 created in Jan 2008 versus the fall of the Sensex of about 61%. Further, in the past one month the Bankex has severely underperformed the Sensex. The same can be seen in the table here.

Among Banks, Public sector banks in particular have managed to book large profits from both lending and non-lending activities, especially treasury operations, during the last quarter. For the current financial year, dividend receipts from the public sector banks, financial institutions, insurance companies and the Reserve Bank of India is estimated at Rs 18,445 cr. Public sector banks’ dividend payouts last year were about Rs. 8,042 cr. This year, public sector banks alone are expected to cough up about Rs. 11,000 cr especially because oil companies (due to fuel subsidies) may not be able to maintain dividend payouts at last year’s levels.

A beginning seems to be have made by Bank of India (1st time interim dividend of 30%. Record date – 09/03/09), Corporation Bank (Interim dividend of 45%. Record Date – 13/03/09) and Indian Bank (1st time interim dividend of 20%. Record date – 12/03/09). The Table clearly summarizes the dividend yield potential of PSU Banks. Do invest in them and benefit taking into consideration the concerns given below.

Concerns

Concerns

1. With the slowdown in the economy and increase in default rates on loans it is possible that banks may need to cut the dividend %. While this seems unlikely for FY09 (E), it is possible in FY10. However, historically, most Indian banks maintained dividends even in adverse times (say between 1996-1999). Also, this fear seems to be partly priced into the current stock price. The dividend payout for FY10 would however depend on the emerging NPA situation, the interest spreads earned and the treasury income of the banks. It is quite likely that financial results of banks for FY09 may not be repeated in FY10 and hence we could see some cutback in dividend in that year.

2. Investors can play the current scenario for short term gains in the form of dividend yield, while those who choose to hold on to the stock may have to face temporary capital erosion and volatile stock price movement.

3. While dividends are tax free in the hand of the investor in case the shares are not sold within three months at a loss, the investor will have to bear other transaction related costs like STT, short term capital gains etc. In case the share prices continue to be below the lower band of the ideal entry level for a few days, one needs to look into the reasons for the same with a view to take further action, including exiting the stock if necessary. Further after buying the stock, if the share price rises sufficiently, one can exit the stock without waiting for receiving the dividend.

No comments:

Post a Comment