There is a saying, When America catches Cold - Rest of world sneezes. You know why? Read on to know:

Post the downgrade, with the markets having somehow digested the news, all eyes are now on how countries holding US Treasuries will react. Most will not sell off as there are simply no other viable alternatives. Despite the downgrade, the truth is that US still remains one of the safest investment option when it comes to Treasuries.

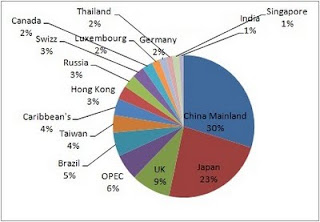

Here is a quick look at the major Treasury holders as at 31st May 2011:

China Mainland – US$1159.80 billion; around 30% of the total treasury holdings by foreigners.

Japan – Second largest holder of US treasury at US$912.4 billion.

United Kingdom (incl. Channel Islands and Isle of Man) - US$346.5billion

Oil Exporters (incl. Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait,Oman, Qatar, Saudi Arabia, the United Arab Emirates, Algeria, Gabon, Libya, and Nigeria) – US$229.8 billion

Brazil – US$211.40 billion

Taiwan – US$153.4 billion

Caribbean Banking Centers (Bahamas, Bermuda,Cayman Islands, Netherlands Antilles and Panama and British Virgin Islands.) – US$148.3 billion.

Hong Kong – US$121.9 billion

Russia – US$115.2 billion

Switzerland – US$108.2 billion

Canada – US$90.7 billion

Luxembourg – US$68 billion

Germany – US$61.2 billion

Thailand – US$59.8 billion

Singapore – US$57.4 billion

India – US$41.0 billion

Source : Department of the Treasury/Federal Reserve Board

No comments:

Post a Comment