While investing in – say a set of 10 stocks, the usual dilemma is how much to invest in each stock. The aspect of allocation of capital to the stock is an area where most novice investors goof up because we can never be sure how much is enough.

To resolve the issue, Raamdeo Agarwal of Motilal Oswal Securities has formulated a new formula called the CAP (Confidence-Adjusted Payoff).

The CAP framework was actually implemented by Warren Buffett whilst managing the portfolio at Buffett Partnerships during the 1960s. Warren Buffett’s golden words provide an apt description of the CAP framework:

“The question always is, ‘How much do I put in number one (ranked by expectation of relative performance) and how much do I put in number eight?’”

Raamdeo has taken Warren Buffett’s advice to its logical conclusion and broken down the steps for CAP-based allocation into the following:

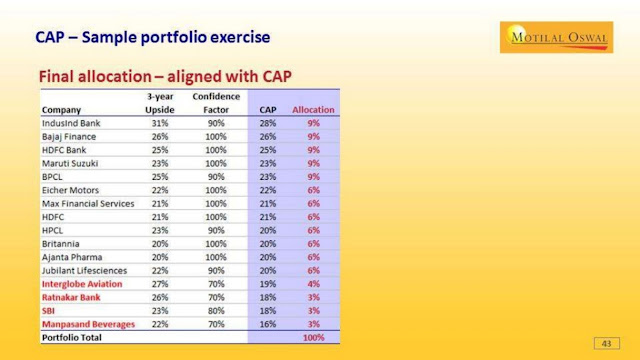

• Rank all the selected stocks in descending order of their expected 3 or 5-year upside.

• To this upside, apply a Confidence factor range from 0 to 100%. The main idea behind the Confidence factor is to deflate the expected upside for risks that may not have been explicitly captured in the upside calculations. (Note: If the Confidence factor is very low, perhaps the very selection may need to be questioned.)

• For each stock, arrive at Confidence-Adjusted Payoff (CAP) i.e. Upside x Confidence factor.

• Rank the stocks in descending order of CAP, and align the final allocation.

The more accurate the assessment of CAP, the higher will be the portfolio performance based on this allocation, rather than any other (e.g. equal weight), the Study says.

It is added that additional norms can be included such as:

• not having any stock with allocation more than 10% of the portfolio value

• not having any stock with allocation less than 3% of the portfolio value

• not having more than 5% equity of any company.

For instance, in the recently concluded Wealth creation study, Raamdeo has identified set of 16 stocks which could see sizable growth in future over the next 3 to 5 years. And he has given the CAP details also. Hope investors find it handy to invest and benefit.

Monday, December 19, 2016

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment