What is cash rich company?

Cash and bank balances indicate the amount of cash that a company has on its books at a specific point in time. The position of cash and bank balances net of debt is one of the indicators of financial strength and liquidity of the company. Cash and bank balances include balance with bank, term deposit with banks and cash in hand/others.

Importance of cash rich company

Analysts suggest that a cash rich company is a sign of financial strength while a small cash position is a possible caution or warning sign. The cash rich companies have an edge over cash strapped companies as cash can be used to fund operations and acquisitions, to buyback shares and to repay debt. It also helps the company to survive in torrid times of recession. A dark side of cash rich company is that too large of a cash position can often signal waste of funds as the funds are placed idle or produce very modest return.

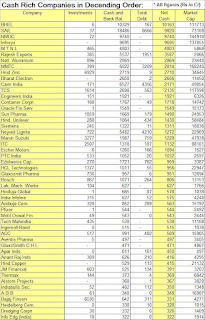

We have taken all the listed companies on the Bombay Stock Exchange. We have taken only those companies whose cash value net of debt is greater than Rs 300 crore and sorted the top 50. We have not taken the investment value into consideration since some companies have invested in government bonds or group companies.

Interestingly, 8 companies out of top 10 cash rich companies by value were PSU companies. You can safely assume these companies to be worthy investment bets.

Very fine tool for long term stock picks sir. Thanks

ReplyDelete