Saturday, February 1, 2025

Monday, January 27, 2025

Catching a falling knife : Maths behind Gain - Loss

Wednesday, October 30, 2024

Muhurat Trading - History

Muhurat Trading is an exceptional trading day - when the time and day is flexed to suit the sentiments of Indian Culture. No other festival - across the globe has got this special treatment.

An inscription dating back to the year 971 CE indicates the beginning of Samvat in 842 CE and is associated with King Vikramaditya. As per several historians, King Chandragupta II conferred upon himself the title of Vikramaditya, also changing the name of that era to 'Vikram Samvat'. And Diwali marks the beginning of new year (Samvat).

The tradition of muhurat trading has its

origins in the BSE in 1957 and was later adopted by the NSE in 1992. Within the

Indian trading community, muhurat trading on Diwali is

considered highly auspicious, and it is believed that participating in this

special trading session can bring wealth and good luck throughout the year.

The celebration of Diwali, with the worship of the goddess

Laxmi, the deity of wealth and prosperity, holds great importance. According to

Hindu tradition, the planets align in favourable positions during this time,

making it especially auspicious for financial endeavours.

Does that mean that investments made on Muhurat trading give you good profits? Not really. It just means new year and you start new book of accounts. And an invest made on the auspicious day marks a new beginning.

Investing is a continuous process. There is no end to it. Same holds true with investing on Muhurat day also.

Monday, August 12, 2024

Olympics of Investing

Sunday, January 14, 2024

What goes... Comes back... The Jet Airways Way

What you do to others WILL come back to you. It is a sort of cause and effect. And when we see LIVE EXAMPLES of such cases, we refrain from inflicting pain on others for selfish gains. At the end - Wise people learn from others mistakes. JET AIRWAYS could be one such example.

Teary-eyed and dejected, aviation veteran Naresh Goyal felt so hopeless about the system that he told a special court last week that he would prefer to die in prison. For a man who ruled Indian skies, that's quite a fall.

While one may pitty the fate of a person who once ruled Indian skies, the reasons that lead to his fall his unethical business tactice can give us a different opinion.

To read the full article, kindly visit: https://www.ndtvprofit.com/bq-blue-exclusive/naresh-goyals-turbulent-ride-from-ruling-indian-skies-to-hopeless-imprisonment

- Hailing from Punjab, Goyal started his career in the late 1960s in a relative's travel agency.

- He quickly learned the ropes and set up Jetair Pvt. in 1974 to provide sales and marketing services to foreign airlines.

- After representing global giants such as Cathay Pacific and Air France for years, he established Jet Airways soon after the Indian economy was liberalised.

- When Jet Airways launched commercial operations in 1993, its competitors were Damania Airways, Sahara India or Air Sahara, ModiLuft and East-West Airlines, along with government-owned Indian Airlines and Air India.

- There was a time when any major aviation policy by the government was speculated to have the prints of Mr.Naresh Goyal's.

- "He knowingly or unknowingly caused more harm to Indian aviation than good through his ways of functioning," Jitender Bhargava, former executive director of Air India, told NDTV Profit. "Goyal prevented airlines from starting operations and later growing by creating stumbling blocks through political clout and influence in the policymaking—only to thwart competition." The 5/20 policy formulated by the government can be cited as one major example of that, according to Bhargava. The policy required carriers to complete five years of commercial operations and own 20-aircraft fleet to begin international operations. No other country had such a rule. Goyal, according to sector watchers, was even said to be behind derailing Air India's divestment in early 2000s.

- Goyal, according to sector watchers, was even said to be behind derailing Air India's divestment in early 2000s.

- The Tata Group, along with Singapore Airlines, had withdrawn the proposal after criticism from trade unions and political backlash.

- As a result, Jet Airways climbed higher and gained domestic market share, backed by its world-class service with no other airline to match it.

- The next step was going public, which it executed successfully. Its initial public offer was subscribed 4.25 times on the first day.

Emerging Threats

- Indian market changed with the launch of new carriers such as InterGlobe Aviation Ltd.'s IndiGo, Air Deccan, SpiceJet and Go Air (now Go First). As the number of flyers increased, low-cost became the name of the game and the quality of services took a back seat.

- Feeling the threat from budget airlines, Goyal overplayed his hand by acquiring Air Sahara for Rs 2,200 crore. After the expensive acquisition, Jet Airways' costs began to balloon on international routes. Rapid network expansion, not enough in-house talent and price war among low-cost carriers created the perfect storm that rocked Jet Airways. The 2008 financial crisis hit demand and oil prices soared. Jet Airways, already burdened with rising costs, resorted to heavy borrowing.

Unending Turbulence

- When Kingfisher Airlines was in dire need of funds and Vijay Mallya was pleading the government to allow foreign airlines to buy stake in domestic carriers, Goyal was reported to be against such a policy and denied the need to tie-up with a foreign carrier. When Mallya's Kingfisher stopped commercial operations in 2012, Jet Airways' efforts for survival came under the spotlight.

- Conveniently, Goyal changed his view: "Today, I may not need FDI, but tomorrow I may need," he was quoted as saying. In another "twist of fate" that year, Jet Airways got a booster as the government changed its foreign direct investment policy. It allowed foreign airlines to own up to 49% stake in Indian carriers, just when Goyal was hunting for more funds to keep Jet Airways going.

- Etihad Airways acquired 24% stake in Jet Airways for Rs 2,000 crore when India and Abu Dhabi agreed to increase flights under the bilateral agreement. But that respite didn't last. Over the next few years, IndiGo's business model, led by single aircraft and frugal operations, became something to imbibe to run a sustainable and profitable airline. Jet Airways again needed funds.

- In April 2019, a consortium led by State Bank of India refused to inject more funds in Jet Airways as it crumbled under huge debt and years of loss. Etihad didn't come to rescue either this time. At the time, Jet Airways operated over 120 aircraft and flew on hundreds of routes. And the airline was grounded and ceased operations. Soon after, the lenders initiated bankruptcy proceedings against the airline and the National Company Law Tribunal admitted the case in June 2019. Allegations came to the fore that Goyal was siphoning funds from the airline. Jet Airways' board, which included Goyal and his wife, had to step down. The Enforcement Directorate began examining Etihad Airways' investment in Jet Airways, reportedly on claims of violation in foreign direct investment rules. Goyal was barred from leaving India.

Losing Hope

- In May 2023, Canara Bank filed a complaint with the Central Bureau of Investigation, accusing Goyal of cheating, criminal conspiracy, criminal breach of trust, and criminal misconduct. Based on the CBI's FIR, he was arrested in September by the Enforcement Directorate for alleged fraud of Rs 538 crore. The case has since been heard in a special court.

- When Goyal first emerged in the aviation scene, many pointed to his charming ways and how he had the potential to become Indian aviation's face after JRD Tata. Years later, during the hearing last week, he stood with folded hands and bowing before the court to express how he's missing his bedridden wife in the jail. "He came before the court with continuous tremors in his whole body and hands," the judge said. The 74-year-old said his wife is bedridden and their only daughter is unwell, too. Referring him to JJ Hospital would be useless and he conveyed reluctance to travel to hospital from the Arthur Road jail.

WHAT GOES... COMES BACK... THE JET AIRWAYS WAY

Monday, January 1, 2024

Reflections of 2023

We had made an YouTube Video on "Roller Coster Ride" on 15th may 2022 - explaining the underlying opportunities in the then lackluster markets. Indeed it was a timely video showcasing the merits of investing.

Infact, it could be interesting to watch this video again and see what we said then:

https://www.youtube.com/watch?v=iNHnDNswCzg

While many of us are rejoicing the market rally, and many think the turning point for markets has been the state election results on November 2023, markets showed signs of growth way back in May 2023 itself - exactly one year after we posted the above mentioned video.

Since FII's were net sellers since october 2021, it was the Mid and Small caps which were ruling the roost till Nov 2023. The state election results gave clarity on upcoming elections and FII's joined the bandwagon to pump in record money in the last two months of 2023.

- Nifty Realty led with an 81% surge, driven by Prestige Estates Projects Ltd., DLF Ltd., and Brigade Enterprises Ltd.

- Nifty Auto and Nifty Pharma also performed well, growing by over 47% and 32%, respectively.

- The auto sector gained due to steady demand, a softening of commodity prices and favourable policy changes this year.

- However, sectors like Nifty Bank, Nifty Oil and Gas, and Nifty Financial Services experienced more modest gains of 11%, 12%, and 12%, respectively.

- Investments made when past year(s) returns have been muted - gives Best returns.

- Last year has been spectacular. Expecting similar kind of returns in 2024 may be tough.

- Run up to the elections is usually noisy. That can create lots of volatality.

- Cut in interest rates is widely expected in 2024. If that happens - that can fan liquidity and fuel inflation too. It can pump up stock price.

- Above all - a run up in stock price (hence MF's NAV) has to be substantiated by rise in earnings. It is ultimately the fundamentals which justify / determine the stock price.

- Having said that - while one year forward may be tough to predict, over next 3 to 5 years Indian economy is bound to do well.

- So Investors who need funds in next 1 years needs to be cautious. All others can invest at every opportunity you may get in the markets.

- But it FII's continue to invest - 2024 could be an year for Large cap's.

Wednesday, December 27, 2023

Be Passionate - Be Crazy - #Motilal Oswal

The difference between being passionate and being crazy is often hazy at best.

The most passionate individuals often seem to be nuts. The most gifted and successful artists, entrepreneurs, scientists, you name it, are often said to be a little crazy.

One such is our Stock broking partner - M/s Motilal Oswal Financial Services at Mumbai. While their office - Motilal Oswal Tower (MOT) is an iconic building in Prabha devi in Mumbai, the things that they do there is sometimes wiered. While illuminating the building to suite the occassion like Christmas or Diwali is ok, there are things that may look crazy to first timers.

It begins with the LIFT BUTTON - For going up - you have BULL symbol and for going down you have a BEAR symbol. That sums it up. Do they mean - what goes up cannot stay there for ever and it has to come down. ... or something else.

And I leave it to your imagination on how dealing room, Cafetaria and wash rooms looks like.

You can breath, see, feel and experience stock market all through this building. Indeed it is a place to visit for stock market investors .

Wednesday, September 6, 2023

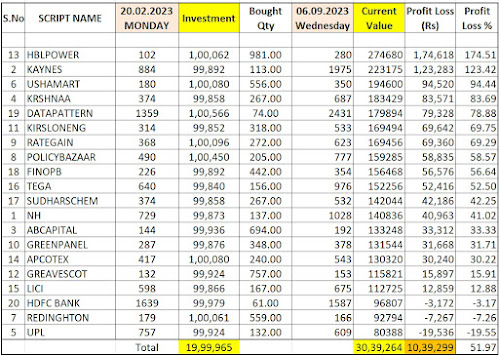

TIA 20-20 : Stock Taking

As I gear up to attend TIA’s Bullet proof Investing on coming Saturday 9th Sept 2023, I was reflecting on the immediate past event – the 20-20 event that happened on 18th Feb 2023.

Tamilnadu Investors Association (TIA) is India’s first investor associations - way back in 1989. it is one of India's finest associations imparting knowledge on regular basis. They conduct two mega PAID events every year : 20-20 being one and Bullet Proof Investing is another. Both events happen in Chennai – on national, if not on international standard. For me, it is like PILGRIMAGE TO OMAHA - to attend Warren Buffet's BERKSHIRE HATHAWAY AGM.

20-20 is an event in which 20 Investors / analysts come and share their investment thesis for 20 minutes each. Hence the name 20-20. The main take away for investors is – they can learn how to approach in analysing – rather than buying a stock blindly on hear say. And if at all one invests, they need to do their due diligence before investing.But the real objective of such meeting is to make investors

involve in evolving an investment process and stay invested for long term.

20-20 Stock Analysis:

This calendar year’s 20-20 event happened on 18th Feb 2023. On Monday – 20th Feb 2023, Sensex was then 60691. As of 6th Sept 2023, while composing this article, Sensex is 65650. On Sensex, that’s a gain of 4959 points or 8% gain.

But the portfolio of stocks discussed in 20-20 event on 18th Feb 2023 has already gained by 51%. And some of the ideas discussed are real DIAMONDS. Out of the 20 stocks, 3 stocks did not fire up. All other have rewarded investors decently.

Moral for investors here is:

- Investors need to put in time and efforts to understand the companies they invest in.

- In this internet age, many investors get lured by Youtube for quick money. They are not ready to do the homework – understand the company, gain conviction and then invest.

- While looking at the list above – it is easy for investors to identify those companies that gave good returns. And many of them would prefer to avoid companies that gave negative returns. But in reality, we know the results only in hindsight. No one – not even the presenter of these investment ideas would have imagined the results. In stock investing, the participation in a companies growth is much more important. Profits are often by-products of this investment journey.

- There is little use in just getting to just know the stock ideas. The real real benefit can flow through only if you invest in those ideas in which you have gained conviction. But to gain conviction you need to spend time in attending such seminars.

- Now, some may think – IS IT WORTH THE TIME?. Taking a day off and attending such events - that too a paid event - may sound like WASTE OF TIME AND MONEY. But the results speak for themselves. I leave it to the readers to decide on the worthiness part.

To conclude – You donot need an invitation to make money. If you wish to make it, you need to be open minded and be willing to learn, invest and benefit.

Saturday, December 31, 2022

How much you need to gain to recover your loss:

We had published an article in this blog way back in 17th Jan 2018 - on the topic When to Cut loss. You may read the article in following link :

https://easyinv.blogspot.com/2018/01/when-to-cut-loss.html

Interestingly a article on similar topic came up recently with a good illustration. Hence thought of publishing it here for better clarity:

Tuesday, December 27, 2022

Saturday, December 24, 2022

Sensex - Past, Present & Future

Below mentioned has been a Whatsapp forward. Found it interesting. Hence publishing. Disclaimer: Data not verified by PR or Easy Investments.

---------------------------------------------------------------------------------------------------

1. BSE completed 43 years.

2. There were around 11,000 trading days in last 43 years.

3. Observations on regular basis and positive and negative returns occurrences.

Frequency Positive Negative

Daily 53% time 47% time

Weekly 56% time 44% time

Monthly 61% time 39% time

Quarterly 64% time 36% time

Yearly 72% time 28% time

3 years 89% time 11% time

5 years 96% time 4% time

10 years 100% time

4. Bse Sensex delivered 15.5% CAGR returns over last 43 years.

5. Decadal returns dispersion

Period CAGR

1980-1990 21.6%

1990-2000 14.3%

2000-2010 17.8%

2010-2020 8.8%.*

2020...to 21Dec,2022..........….24.8%

6. BSE Sensex returns 15.5%. Add 1.4% average dividend yield of 1.4% of last 43 years. At 16.9% compounding the value of BSE is actually around 80,000 level.

7. Longest period without returns was from 1994 till 2003. 9 years in total.

8. Since 2002 in last 18 years NO single 7 years rolling returns were without returns. This means since 2002 if you ever invested and kept money for minimum period of 7 years then you would have never lost money.

9. But what is most surprising and rewarding has been the performance of actively managed equity funds. Here are the data:

Category 20 years

CAGR

Hybrid 15.17% 15.96%

Hybrid - ex 16.37% 16.74%

Diversified 18.11% 16.25%

Diversified-ex 19.89% 18.10%

ELSS 18.45% 18.20%

ELSS-ex 19.66% 21.47%*

*All Funds 17.52% 16.41%

All Funds-ex 18.73% 18%*

* excluding LIC/JM/Taurus/Quant MF schemes. This mean schemes of HDFC/ Nippon (earlier Reliance)/ Birla/ ICICI Pru/ SBI/ Principal/ Canara Rebecco/ Franklin etc.)

10. BSE Sensex was at 3800 in June 1996 (26years back). In last 26 years average-ex MF delivered 18% CAGR. Had BSE Sensex delivered as much as average MF schemes then the value of BSE Sensex should have been:*

At 16.4% CAGR, BSE Sensex should be around 1,70,000 levels

At 18% CAGR, BSE Sensex should be around 2,38,000 levels.

Wednesday, August 19, 2020

Investing Demystified

It is natural to save for the rainy days. You would have seen ants carrying grains and depositing them in their homes. Since these are successful traits, many species, including human beings have inherited them.

Monday, December 24, 2018

Is it Time - Women adorn the 'Hat of Investor' and contribute to their families?

Basics of Mutual Funds...Wealth Creation Strategies...செல்வம் சேர்க்கும் செயல்திட்டம்:

We prepared an all new presentation that could connect well with the public, that too in Tamil - hence was well received by the audience. We were quiet satisfied with the results.

Should you invest based on Dividends declared by Shares?

Thursday, July 12, 2018

De-Compound Interest:

Friday, August 5, 2016

All about GST:

Stage 1 : Manufacturer Stage

Let's assume that a manufacturer of shirt buys raw materials like cloth, thread, buttons and other equipment that is required to stitch the shirt. This raw material costs the manufacturer Rs 200. This Rs 200 includes a tax – say @ 10% tax - Rs 20. Once the shirt is made, the manufacturer has added his own value to the input material say Rs 60. Then the total cost of the shirt is now Rs 260 (Rs 200 + Rs 60). With a 10% tax rate, the tax on this shirt would be Rs 26. However, since the manufacturer has already paid Rs 20 as tax while purchasing raw material, under GST the tax incidence will now be only Rs 6 (Rs 26 - Rs 20).

Stage 2 : Wholesaler Stage

Now, the wholesaler would buy the trousers at Rs 260 sells at Rs 300. Applying the same 10% principle, the tax would amount to Rs 30. But, out of this Rs 30, Rs 26 are already accounted for from stage one. So the effective tax incidence for the wholesaler would be Rs 4 (Rs 30 - Rs 26).

Stage 3: Retailer Stage

Now that the retailer has bought the trousers at Rs 300, and sells it at Rs 320. Using the 10% rule, the tax would be Rs 32. However, with Rs 30 already accounted for in the earlier two stages, the tax incidence would be Rs 2* (Rs 32 - Rs 30).

To sum up, the total GST for the entire chain, from manufacturer to retailer is Rs (20 + 6 + 4 + 2 = 32). This eliminates cascading effect.

- Online Shopping : GST

is expected to bring down the cost of logistics significantly, even making

inter-state trade smoother because of a uniform tax rate. This will

facilitate faster movement of goods across the country and help bring down

costs for e-commerce companies. Overtime, e-commerce companies are

expected to pass on the benefits of this to the end consumer.

- Branded Clothes! :

Excise duty and VAT will be subsumed under the GST. This will make branded

clothes cheaper.

- Cars and Two wheelers : The

automobile industry may be the biggest beneficiary of the GST. From making

cost to spare parts, paint, logistics, the cost is likely to come down at

every level of manufacturing and sale of a model. Right now, the prices

are different across various states, this will also be done away with with

GST.

- LED TVs : Currently, there's a 24.5% tax on a Rs

20,000 LED TV. With the GST rate likely to be fixed at 18-20% band, you

will shell out less for LED TVs and other gadgets.

- Building materials

- White Goods : A/c, Fan, Mobile phone

- Consumer Goods : Paints

- Processed goods

- Cements

- Buying a house,

- Movie tickets

- Eating Out : Yes,

your restaurant bills and eating out bills are likely to go up once GST is

rolled outSo, be ready to pay more for outside food!

- Say goodbye to cheap calling on mobile phones! : On your mobile bill, there is a service tax of 15% currently. If

GST comes in at the expected 18-20%, then your mobile bills will go.

- Jewellery to become more expensive :If you are planning to buy jewellery, it will be advisable to buy

it before the GST regime comes into place. This is because, currently,

only a 2% effective tax passed on to the consumer but once the GST model

is in place, at least 6% effective tax rates could be imposed, impacting

your jewellery buys.

- Banking

- Insurance

- Clothes

- Travelling

- Sporting events

- Ambulance Services

- Cultural Programs

- Trucks

- Pilgrimages

Monday, May 2, 2016

Basic Facts about Bonus Shares:

Though many investors get lured by 'FREE' shares, post bonus the share price falls. For instance if the share price is Rs.100 and the company issued 1:1 bonus, then post bonus the number of sharesee increases to 200 and the share price falls to Rs.50. Thus making the total value of investment the same.

Once investors realize this, they feel there is no meaning in investing for the sake of bonus. They feel it makes no economic sense. This could be due to misconception of facts behind Bonus.

Bonus is:

- Non cash transaction.

- It is issued for free to existing share holders in a ratio like 1:1 or 1:2 etc

- Post bonus, the number of shares increases - thus increasing the liquidity.

- Increase in liquidity coupled with lower share price - makes it affordable for more number of investors to buy these shares. Thus increasing the share holder base.

- More number of share holders results in more public scrutiny and improved price discovery.

- Inspite of any number of bonus shares, the face value of the shares remain constant. Unless the shares are split (when face value of the shares are split), the face value remains constant.

- And if the company maintains constant dividend or improved dividend in percentage terms, then the share holder stands to gain immensely. And the dividend yield ratio increases since the same percentage dividend on reduced share price (post bonus) makes it even more attractive.

Thursday, April 28, 2016

All about ASBA :

Originally IPO was applied by filling up applications and issuing a cheque, against which shares were alloted depending on the demand. If more people applied, lesser the number of shares or lesser number of investors were alloted - mostly in physical certificates. This is called as over subscription of the issue and the IPO allotment is often a sticky secrete known only to the registrar of the issue.

Since the advent of Demat and acceptance of Demat as a safe way to hold securities, IPO shares are now mostly alloted in Demat mode. Even if you opt for physical certificate, you need to demat them before selling them.

And one more recent development has been applying for IPO in ASBA mode. Many investors who used to avail IPO offers are often perplexed at what all this ASBA is about. And the reality is you cannot apply in IPO without ASBA. Many investors are not aware of it and in the last minute get disappointed since they donot have an ASBA Account.

Hence we thought of publishing basic facts about ASBA:

1. What is “ASBA”?

ASBA means “Application Supported by Blocked Amount”. ASBA is an application containing an authorization to block the application money in the bank account, for subscribing to an issue. If an investor is applying through ASBA, his application money shall be debited from the bank account only if his/her application is selected for allotment after the basis of allotment is finalized, or the issue is withdrawn/failed.

2. Detailed procedure of applying in IPO through ASBA.

Under ASBA facility, investors can apply in any public/ rights issues by using their bank account. Investor submits the ASBA form (available at the designated branches of the banks acting as SCSB) after filling the details like name of the applicant, PAN number, demat account number, bid quantity, bid price and other relevant details, to their banking branch by giving an instruction to block the amount in their account. In turn, the bank will upload the details of the application in the bidding platform. Investors shall ensure that the details that are filled in the ASBA form are correct otherwise the form is liable to be rejected.

3. Who can apply through ASBA facility?

SEBI has been specifying the investors who can apply through ASBA. In public issues w.e.f. May 1, 2010 all the investors can apply through ASBA. In rights issues, all shareholders of the company as on record date are permitted to use ASBA for making applications provided he/she/it

- is holding shares in dematerialized form and has applied for entitlements or additional shares in the issue in dematerialised form;

- has not renounced its entitlements in full or in part;

- is not a renouncee;

- who is applying through blocking of funds in a bank account with the SCSB

The investor can generate e-form from NSE website for any issue. The same link is also available on BRLM’s (Book running lead manager) website also.

5. What advantage an investor has in applying through ASBA?

Applying through ASBA facility has the following advantages:

(i) The investor continues to earn interest on the application money as the same remains in the bank account.

(ii) The investor does not have to bother about refunds, as in ASBA only that much money to the extent required for allotment of securities, is taken from the bank account only when his application is selected for allotment after the basis of allotment is finalized.

6. Is it mandatory to apply through ASBA only?

It is mandatory for all public issues opening on or after January 01, 2016.

7. Where should I submit my Application Supported by Blocked Amount (ASBA)?

Investor may submit application form to his trading member or to a SCSB. List of Self Certified Syndicate Banks (SCSBs) and their designed branches i.e. branches where ASBA application form can be submitted, is available on the websites

NSE (URL:http://www.nseindia.com/content/ipo/scsb_list.zip) and on the website of SEBI (www.sebi.gov.in).

The list of SCSB would also be given in the ASBA application form.

8. What is Self certified Syndicate Bank (SCSB)?

SCSB is a bank which is recognized as a bank capable of providing ASBA services to its customers. Names of such banks would appear in the list available on the website of SEBI and the same is also available on NSE website.

9. Can I submit ASBA in any of the banks specified in the list of SCSBs?

No, ASBA can be submitted to the SCSB with which the investor is holding the bank account.

10. How many applications can be made from a bank account?

Five (5) applications can be made from a bank account per issue.

11. Am I required to submit ASBA only physically?

No, you can either fill up the physical form and submit the same to the SCSB/Trading member or apply electronically/online through the internet banking facility/online facility (if provided by your SCSB/Trading member).

12. Who should I approach if I find that I had given all correct details in the ASBA form, but application has been rejected stating wrong data?

You have to approach the concerned SCSB for any complaints regarding your ASBA applications. SCSB is required to give reply within 15 days.

In case, you are not satisfied, you may write to SEBI thereafter at the following address:

Investor Grievance Cell,

Office of Investor Assistance and Education,

Securities and Exchange Board of India

Plot No.C4‐A,'G' Block, Bandra Kurla Complex,

Bandra(East), Mumbai: 400051

Tel: +91‐22‐26449000 / 40459000 Fax: +91‐22‐26449016‐20 / 40459016‐20

13. Whether my bank account will be blocked or only the amount to the extent of application money is blocked?

No. the entire bank account will not be blocked. Only the amount to the extent of application money authorized in the ASBA will be blocked in the bank account. The balance money, if any, in the account can still be used for other purposes. F

14. If I withdraw my bid made through ASBA, will the bank account be unblocked immediately?

If the withdrawal is made during the bidding period, the SCSB deletes the bid and unblocks the application money in the bank account. If the withdrawal is made after the bid closure date, the SCSB will unblock the application money only after getting appropriate instruction from the Registrar, which is after the finalization of basis of allotment in the issue.

15. Do I necessarily need to have a DP account with the SCSB where I intend to submit the ASBA application?

No. Investors need not necessarily have their DP account with the SCSB, where they are submitting the form.

16. Can I submit my ASBA application to a broker?

Yes. You can submit the ASBA application to your broker.

17. Who is responsible for errors in the data uploaded in the electronic bidding system in case of public issue?

In case there is an error in the data furnished in the application form submitted by investor, the investor shall be responsible. In case there is an error by SCSB/Trading member in entering the data in the electronic bidding system of the stock exchanges, the SCSB/Trading member shall be responsible.

18. Will I get the acknowledgement of receipt for applications submitted through ASBA?

Yes. The SCSB/Trading member shall give a counterfoil as an acknowledgement at the time of submission of ASBA and also the order number, generated at the time of uploading the application details, if sought by the investors in case of need.

19. What happens when the issue fails/is withdrawn?

In case the issue fails/withdrawn the SCSB shall unblock the application money from the bank accounts upon receiving instructions from the Registrar.

20. In case of any complaints regarding ASBA application whom can I approach? In case of any complaints the investor shall approach the bank, where the application form was submitted or the Registrars to the issue.

21. In case a person is having bank account with a branch, for example, at Kolkata can he submit IPO application through ASBA at a branch of the bank in Guwahati.

Yes, this can be done provided that your bank have core banking facility and the ASBA form is submitted at a branch which is identified as designated branch by the bank.

Following are few ASBA enabled Banks:

- Axis Bank

- Bank of Baroda

- Canara Bank

- Central Bank of India

- Dena Bank

- ICICI Bank

- IDBI Bank

- KVB

- Kotak Bank

- PNB

- SBI

- Union Bank of India.