1. "An investment in knowledge pays the best interest." - Benjamin Franklin

When it comes to investing, nothing will pay off more than educating yourself. Do the necessary research, study and analysis before making any investment decisions.

2. "Bottoms in the investment world don't end with four-year lows; they end with 10- or 15-year lows." - Jim Rogers

While 10-15 year lows are not common, they do happen. During these down times, don't be shy about going against the trend and investing; you could make a fortune by making a bold move - or lose your shirt. Remember quote #1 and invest in an industry you've researched thoroughly. Then, be prepared to see your investment sink lower before it turns around and starts to pay off.

3. "I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful." - Warren Buffett

Be prepared to invest in a down market and to "get out" in a soaring market. (For more, read Think Like Warren Buffett.)

4. "The stock market is filled with individuals who know the price of everything, but the value of nothing." - Phillip Fisher

Another testament to the fact that investing without an education and research will ultimately lead to regrettable investment decisions. Research is much more than just listening to popular opinion.

5. "In investing, what is comfortable is rarely profitable." - Robert Arnott

At times, you will have to step out of your comfort zone to realize significant gains. Know the boundaries of your comfort zone and practice stepping out of it in small doses. As much as you need to know the market, you need to know yourself too. Can you handle staying in when everyone else is jumping ship? Or getting out during the biggest rally of the century? There's no room for pride in this kind of self-analysis. The best investment strategy can turn into the worst if you don't have the stomach to see it through.

6. "How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case." - Robert G. Allen

Though investing in a savings account is a sure bet, your gains will be minimal given the extremely low interest rates. But don't forgo one completely. A savings account is a reliable place for an emergency fund, whereas a market investment is not. (To learn more, see Savings Accounts Not Always The Best Place For Cash Assets.)

7. "Invest in yourself. Your career is the engine of your wealth." - Paul Clitheroe

We all want wealth, but how do we achieve it? It starts with a successful career which relies on your skills and talents. Invest in yourself through school, books, or a quality job where you can acquire a quality skill set. Identify your talents and find a way to turn them into an income-generating vehicle. In doing so, you can truly leverage your career into an "engine of your wealth."

8. "Every once in a while, the market does something so stupid it takes your breath away." - Jim Cramer

There are no sure bets in the world of investing; there is risk in everything. Be prepared for the ups and downs. (To read more on how Cramer makes his pick, see Cramer's 'Mad Money' Recap: Tools of the Trade.)

9. "The individual investor should act consistently as an investor and not as a speculator." - Ben Graham

You are an investor, not someone who can predict the future. Base your decisions on real facts and analysis rather than risky, speculative forecasts.

10. "It's not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for." - Robert Kiyosaki

If you're a millionaire by the time you're 30, but blow it all by age 40, you've gained nothing. Grow and protect your investment portfolio by carefully diversifying it, and you may find yourself funding many generations to come.

11. "Know what you own, and know why you own it." - Peter Lynch

Do your homework before making a decision. And once you've made a decision, make sure to re-evaluate your portfolio on a timely basis. A wise holding today may not be a wise holding in the future.

12. "Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this." - Dave Ramsey

By being modest in your spending, you can ensure you will have enough for retirement and can give back to the community as well.

13. "Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas." - Paul Samuelson

If you think investing is gambling, you're doing it wrong. The work involved requires planning and patience. However, the gains you see over time are indeed exciting! (For more reasons to be patient, check out Patience Is A Trader's Virtue.)

14. "I would not pre-pay. I would invest instead and let the investments cover it." - Dave Ramsey

A perfect answer to the question: "Should I pay off my _____(fill in the blank) or invest for retirement?" That said, a credit card balance ringing up 30% can turn into a black hole if not paid off quickly. Basically, pay off debt at high interest rates and keep debt at low ones.

15. "The four most dangerous words in investing are: 'this time it's different.'" - Sir John Templeton

Follow market trends and history. Don't speculate that this particular time will be any different. For example, a major key to investing in a particular stock or bond fund is its performance over five years. Nothing shorter.

16. "Wide diversification is only required when investors do not understand what they are doing." - Warren Buffett

In the beginning, diversification is relevant. Once you've gotten your feet wet and have confidence in your investments, you can adjust your portfolio accordingly and make bigger bets. (For more reason to reduce your diversification, read The Dangers Of Over-Diversifying Your Portfolio.)

17. "You get recessions, you have stock market declines. If you don't understand that's going to happen, then you're not ready, you won't do well in the markets." - Peter Lynch

When hit with recessions or declines, you must stay the course. Economies are cyclical, and the markets have shown that they will recover. Make sure you are a part of those recoveries!

The Bottom Line

The world of investing can be cold and hard. But if you do thorough research and keep your head on straight, your chances of long-term success are good. Refer back to these quotes when you're feeling shaky or are confused about investing. How are they relevant to your experience? Do you have any favorite quotes to add? (To learn more from great investors, read Greatest Investors.)

Showing posts with label Secrets of Wealth Creation. Show all posts

Showing posts with label Secrets of Wealth Creation. Show all posts

Friday, October 31, 2014

Sunday, December 2, 2012

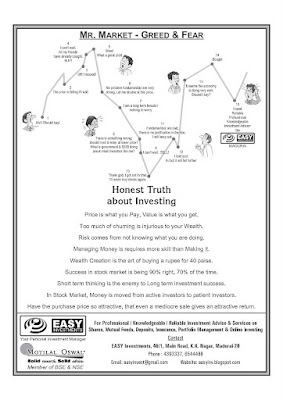

Emotionless Investing:

Investor’s biggest enemies are not the volatile markets / unstable government / lack of reforms, but their own emotions. In many occasions, they are tempted to make investments when they SHOULD NOT HAVE made it and in other occasions they prefer not to invest when they SHOULD HAVE made it.

Theoretically speaking, an investor needs to:

- Invest when Purchase Price is ‘Cheap’ / Valuations are ‘Cheap’.

- Keep Investing (adding) as the price gets cheaper.

- With each price fall, you should be investing more for better Return on Investments.

- Invest with specific target price (profit) in mind and ‘Blindly’ sell when your profit reaches.

- Have clear distinction between Long Term Investments and Short Term investments.

- Invest only in Top Class companies with proven track record and good management.

- Not invest in penny stocks / fancy stocks (not to chase stocks) which may fly high due to media publicity.

- Above all – Research - before you invest – Not after investing.

All these facts are known to everyone. But when it comes to practical implementation, it is definitely difficult – all due to emotions. Investors turn pessimistic when no one is investing and Investors are hyper-optmistic (euphoric) when everyone is investing. By and large, Investing happens to be a ‘mass mentality’ process.

To overcome this 'EMOTION' problem, we need NEUTRAL, Unbiazed Strategies. At EASY Investments, we have deviced Investment strategies for specific requirement. Some of them may fit your requirements. Hence read our specific articles on following to know more:

Monday, December 26, 2011

Monday, August 1, 2011

Wealth Creation Quiz:

Match the place of residence given below to the following men.

World's Richest Man: Carlos Slim

World's Second Richest man : Bill Gates

World's Third richest man : Warren Buffet

World's Fourth richest man : Bernard Arnault

And Where do they stay?

World's Largest House

World's 2nd largest house

World's 3rd largest house

World's 4th largest house

Answer: None of the answers given above matches the place of residence of the men given above. Isn't that so odd? The richest men not living in the biggest houses.

Then, what is the use of having so much money?

The shocker: The 3rd Richest man in the world stays in a five bedroom house brought in 1958 and that today is valued at around USD 700,000 (although this works out to Rs 3.5 crore if we take the current exchange rates, it is only around a crore in PPP terms). Today almost 10% of Indians would be having a house in excess of Rs 1 Crore.

So does that mean that Warren Buffet is a miser? With over $50 Billion in wealth, he still stays in a 53-year-old house that too with "just" five bedrooms. He surely must be bluffing about his wealth, because, we know for sure he is not bluffing about the house! Or is he?

Well not at all. His known public wealth is 50 billion dollars and growing.

So why does the world's third richest man stay in such a small house?

No, Warren Buffet is not stingy or miserly by any means; not anyone who donates 30 Billion to charity can be one. Rather, he has mastered the art of creating wealth.

Wealth is not created just by investing, but, also by avoiding unnecessary expenses.

It's not called 'stingy', rather, it's called 'Frugality'. This frugality has helped him grow his wealth year on year.

His logic is simple: An extra ten rooms in the house is not going to create any major difference to him. However, the same money if invested rightly (of which he is a master) can be made to grow to probably ten times the same amount.

Yes, it is not easy for all of us to be like him. Others might say that he can "afford" to be frugal because he already has so much wealth and does not need to worry about anything else. True, but he has stayed the same way even when he was poor!

If Warren Buffett can do it on such a large scale, we can at least do it on a smaller scale. The secret lies in falling in love: In love with growing wealth. If you can fall in love with the happiness that one gets by seeing his wealth grow, you will automatically start repelling the evil twin: spending.

Initially it may be very difficult and you may not even be able to follow. But, once you get accustomed to it. you realize that the pain of sacrificing current consumption is much smaller as compared to the thrill of creating long term wealth. The 20,000 Rupees saved by going for a simple phone (rather than a gold studded one) can in the coming years grow into Rs 200000 and give you the power to be a giver.

"The fundamental is to make sure we give priority to the needs and minimize the wants. Happy Frugality!"

World's Richest Man: Carlos Slim

World's Second Richest man : Bill Gates

World's Third richest man : Warren Buffet

World's Fourth richest man : Bernard Arnault

And Where do they stay?

World's Largest House

World's 2nd largest house

World's 3rd largest house

World's 4th largest house

Answer: None of the answers given above matches the place of residence of the men given above. Isn't that so odd? The richest men not living in the biggest houses.

Then, what is the use of having so much money?

The shocker: The 3rd Richest man in the world stays in a five bedroom house brought in 1958 and that today is valued at around USD 700,000 (although this works out to Rs 3.5 crore if we take the current exchange rates, it is only around a crore in PPP terms). Today almost 10% of Indians would be having a house in excess of Rs 1 Crore.

So does that mean that Warren Buffet is a miser? With over $50 Billion in wealth, he still stays in a 53-year-old house that too with "just" five bedrooms. He surely must be bluffing about his wealth, because, we know for sure he is not bluffing about the house! Or is he?

Well not at all. His known public wealth is 50 billion dollars and growing.

So why does the world's third richest man stay in such a small house?

No, Warren Buffet is not stingy or miserly by any means; not anyone who donates 30 Billion to charity can be one. Rather, he has mastered the art of creating wealth.

Wealth is not created just by investing, but, also by avoiding unnecessary expenses.

It's not called 'stingy', rather, it's called 'Frugality'. This frugality has helped him grow his wealth year on year.

His logic is simple: An extra ten rooms in the house is not going to create any major difference to him. However, the same money if invested rightly (of which he is a master) can be made to grow to probably ten times the same amount.

Yes, it is not easy for all of us to be like him. Others might say that he can "afford" to be frugal because he already has so much wealth and does not need to worry about anything else. True, but he has stayed the same way even when he was poor!

If Warren Buffett can do it on such a large scale, we can at least do it on a smaller scale. The secret lies in falling in love: In love with growing wealth. If you can fall in love with the happiness that one gets by seeing his wealth grow, you will automatically start repelling the evil twin: spending.

Initially it may be very difficult and you may not even be able to follow. But, once you get accustomed to it. you realize that the pain of sacrificing current consumption is much smaller as compared to the thrill of creating long term wealth. The 20,000 Rupees saved by going for a simple phone (rather than a gold studded one) can in the coming years grow into Rs 200000 and give you the power to be a giver.

"The fundamental is to make sure we give priority to the needs and minimize the wants. Happy Frugality!"

Monday, July 11, 2011

Tuesday, June 28, 2011

Sunday, June 19, 2011

Saturday, August 7, 2010

Friday, May 7, 2010

Top 10 Investment Lessons from IPL 20-20

Sport can teach us a lot about life. Here are 10 things we have learned about investing from the IPL T20 tournament.

1. Start early: T20 does not reward late starters. Teams must start putting runs early in their innings, otherwise it can get too late and the surviving batsmen are always playing catch up.

Similarly, we must also start investing and saving early. This allows us to benefit from compounding of capital, as well as allows us to “keep the scoreboard ticking” in order to move closer to our financial goals.

Additionally, we have seen how batting sides take advantage of fielding restrictions early in the innings. Similarly, early in our innings during our youth we must also take advantage of the freedom to do things that we might not be able to later in life. One of these freedoms is to start building our financial resources when we have very few other financial obligations

2. Risk and Reward tradeoff: T20 is all about taking high risks and ensuring that the team gets rewarded for it – whether its aggressive opening batsmen, or field placing or trying out new bowlers. Finance is all about a tradeoff between risk and reward – you just cannot get rewards without taking on risk, just like a batsman faces the risk of being caught at the boundary if he is trying to hit a six.

If we chase high returns, we must be ready to take on the accompanying risks. Also, just like not every ball can be hit for a boundary, not every investment will turn out to be a goldmine. Sometimes singles are equally important to keep the scoreboard ticking

3. Be ready for the unexpected: In case of rain or weather related delays, the Duckworth-Lewis method gets used and can lead to unexpected outcomes. A team must be prepared for the unexpected and the only way is through having already scored enough runs whatever the stage of the game.

Similarly, our investments must also always be ready to deal with unexpected situations that life might throw at us. We must have enough of a margin of safety to be able to protect ourselves against the proverbial rainy days that we might face in life

4. Strategic break: Strategic breaks help teams to review their progress and plan for the remaining overs. Similarly, as individuals we too must do the same. Unless we regularly review how well our finances our doing and how we must tackle the challenges that the future will throw our way, we might not end up meeting our targets

5. Balance: Just like a T20 team needs the right balance of big hitters, anchors and effective bowlers, our investment portfolio also needs the right balance of investments. Too much of growth or aggressive funds, without a stable foundation of high quality diversified large cap funds, might end up with too much imbalance that can hurt our portfolio. Our investments must be diversified across sectors and different assets, and not be concentrated in any one area

6. One bad over: One bad over can change the direction of a game. If a team does not have enough runs on the board (if you are batting) or enough wickets already (if you are bowling) a bad over can really upset the rhythm and momentum. Sometimes in life one also goes through a “bad over” which could take the form of a job loss, or serious injury or illness

If we do not have an adequate safety net then our personal financial situation can be beyond repair. Again for this reason we must get into the habit of investing and saving regularly so that we are prepared for a bad patch if it were to arise

7. Consistency gets rewarded: The Purple cap or Orange cap are given to the best performing bowler or batsman respectively, a reward for their consistent performance. We too must strive to get this Purple or Orange cap when it comes to our personal finances.

What matters most is that we have consistent performance over a long period of time. There is no point in investing in a fund that is really hot in one year, but a poor performer at all other times. After all, a player who bats or bowls well in one match but is very poor in all other matches is not going to survive too long

8. Coaching helps: T20 teams have got specialist coaches for batting, bowling, fielding and for the overall team. During the month long tournament, the IPL has shown us that some guidance and direction from experts, especially an objective view from the outside, can over time help improve a team’s performance and facilitate meeting a team’s goals.

Similarly, our investments can also benefit from some guidance and expertise, especially to get a check on whether we are doing the right things to meet our financial goals. All of us need some coaching that we are not making careless mistakes that might hurt us later on in life

9. Distractions can be entertaining but ultimately the score matters: T20 is highly entertaining not only on the pitch but also because of all the music and dancing. But, ultimately a team wins or loses on the back of the score that it has made.

Similarly, in investing distractions like the hottest investments or the fads of the month will come and go - what matters is that our “investment scorecard” shows a healthy average. We must focus on what matters and ignore the noise and distractions in the market

10. Winning attitude: The IPL has shown that even young players with lesser talent or resources than the great cricketers can do well if they bring the right attitude to the pitch. Similarly, investing is not just about being rich or already having lots of money.

We can start with few resources and little experience but over time make a fortune for ourselves through a positive attitude and willingness to learn from our mistakes.

We should not get disheartened if one of our investments has lost money. Just like a young cricketer who believes in himself, we should believe in what we have invested in and stick it out. If we have put in the right kind of preparation, we will also come out the winner over the long run

Message forwarded by Mr.D.Satheesh Kumar,

Cluster Head : Reliance Capital Asset Management Ltd, Madurai

1. Start early: T20 does not reward late starters. Teams must start putting runs early in their innings, otherwise it can get too late and the surviving batsmen are always playing catch up.

Similarly, we must also start investing and saving early. This allows us to benefit from compounding of capital, as well as allows us to “keep the scoreboard ticking” in order to move closer to our financial goals.

Additionally, we have seen how batting sides take advantage of fielding restrictions early in the innings. Similarly, early in our innings during our youth we must also take advantage of the freedom to do things that we might not be able to later in life. One of these freedoms is to start building our financial resources when we have very few other financial obligations

2. Risk and Reward tradeoff: T20 is all about taking high risks and ensuring that the team gets rewarded for it – whether its aggressive opening batsmen, or field placing or trying out new bowlers. Finance is all about a tradeoff between risk and reward – you just cannot get rewards without taking on risk, just like a batsman faces the risk of being caught at the boundary if he is trying to hit a six.

If we chase high returns, we must be ready to take on the accompanying risks. Also, just like not every ball can be hit for a boundary, not every investment will turn out to be a goldmine. Sometimes singles are equally important to keep the scoreboard ticking

3. Be ready for the unexpected: In case of rain or weather related delays, the Duckworth-Lewis method gets used and can lead to unexpected outcomes. A team must be prepared for the unexpected and the only way is through having already scored enough runs whatever the stage of the game.

Similarly, our investments must also always be ready to deal with unexpected situations that life might throw at us. We must have enough of a margin of safety to be able to protect ourselves against the proverbial rainy days that we might face in life

4. Strategic break: Strategic breaks help teams to review their progress and plan for the remaining overs. Similarly, as individuals we too must do the same. Unless we regularly review how well our finances our doing and how we must tackle the challenges that the future will throw our way, we might not end up meeting our targets

5. Balance: Just like a T20 team needs the right balance of big hitters, anchors and effective bowlers, our investment portfolio also needs the right balance of investments. Too much of growth or aggressive funds, without a stable foundation of high quality diversified large cap funds, might end up with too much imbalance that can hurt our portfolio. Our investments must be diversified across sectors and different assets, and not be concentrated in any one area

6. One bad over: One bad over can change the direction of a game. If a team does not have enough runs on the board (if you are batting) or enough wickets already (if you are bowling) a bad over can really upset the rhythm and momentum. Sometimes in life one also goes through a “bad over” which could take the form of a job loss, or serious injury or illness

If we do not have an adequate safety net then our personal financial situation can be beyond repair. Again for this reason we must get into the habit of investing and saving regularly so that we are prepared for a bad patch if it were to arise

7. Consistency gets rewarded: The Purple cap or Orange cap are given to the best performing bowler or batsman respectively, a reward for their consistent performance. We too must strive to get this Purple or Orange cap when it comes to our personal finances.

What matters most is that we have consistent performance over a long period of time. There is no point in investing in a fund that is really hot in one year, but a poor performer at all other times. After all, a player who bats or bowls well in one match but is very poor in all other matches is not going to survive too long

8. Coaching helps: T20 teams have got specialist coaches for batting, bowling, fielding and for the overall team. During the month long tournament, the IPL has shown us that some guidance and direction from experts, especially an objective view from the outside, can over time help improve a team’s performance and facilitate meeting a team’s goals.

Similarly, our investments can also benefit from some guidance and expertise, especially to get a check on whether we are doing the right things to meet our financial goals. All of us need some coaching that we are not making careless mistakes that might hurt us later on in life

9. Distractions can be entertaining but ultimately the score matters: T20 is highly entertaining not only on the pitch but also because of all the music and dancing. But, ultimately a team wins or loses on the back of the score that it has made.

Similarly, in investing distractions like the hottest investments or the fads of the month will come and go - what matters is that our “investment scorecard” shows a healthy average. We must focus on what matters and ignore the noise and distractions in the market

10. Winning attitude: The IPL has shown that even young players with lesser talent or resources than the great cricketers can do well if they bring the right attitude to the pitch. Similarly, investing is not just about being rich or already having lots of money.

We can start with few resources and little experience but over time make a fortune for ourselves through a positive attitude and willingness to learn from our mistakes.

We should not get disheartened if one of our investments has lost money. Just like a young cricketer who believes in himself, we should believe in what we have invested in and stick it out. If we have put in the right kind of preparation, we will also come out the winner over the long run

Message forwarded by Mr.D.Satheesh Kumar,

Cluster Head : Reliance Capital Asset Management Ltd, Madurai

Sunday, May 2, 2010

Subscribe to:

Posts (Atom)