Many investors call us to consult if they should invest in Guranteed NAV product. Some of them confess that the the Insurance Agent along with their Sales managers are pestering him and are compelling them to invest. These sales people often show 'sugar coated' reports to persuade the prospect.

And the fact is, many clients are often brain washed that they firmly believe that these 'innovations' are the best products on earth. Infact when one of the investor called up the insurance company to close his 'not so performing' ULIP, an army of sales managers repeatedly met him in person and saw to that the older ULIP was closed and the entire money was reinvested in the products like 'Guranteed NAV" ULIP. Inspite of our persuation, newspaper articles and reviews, the client fell in the trap. May be he would realize the mistake when it is already late.

For the benfit of all such investors who want clarity on products like Guranteed NAV, we are publishing a few articles.

Following article appeared in Economic Times Newspaper.

.................................................................................

It is guaranteed,” said the relationship manager (RM), stretching the ‘ees’ for emphasis. He needn’t have. I got the idea, or at least, pretended to. The guaranteed- NAV Ulip (unitlinked insurance plan) would ensure that I earn the highest returns the market delivered during the tenure of the policy. A false smile in place, I sat back on the plush couch of the private sector bank.

Ostensibly, I was digesting the implication, guaranteed returns from an equities instrument for 10 years. The absurdity of the promise was clear. How are investors misled so easily? Don’t they crunch numbers or ask how the insurance company will assure high returns consistently? Oblivious to my thoughts, the RM had ordered two cups of coffee and the application form of the Ulip. May be it was my imagination, but his smile seemed smug.

“You have to sign on every page of the form. I will fill up the other details. You are investing Rs 1 lakh a year, right?” asked the RM, breaking my reverie. True to my part of a gullible 34-year-old investor, I merely glanced through the form.

Busy, impatient investors did not read through the fine print. It was supposed to be a waste of time. The problem was I had no intention of investing a single rupee in the instrument. The charade had got the better of me. So there I was, stalling for time, groping for an ingenuous excuse to get out.

“Can you please explain once more how is the NAV guaranteed?” I asked. It was lame, but nothing else came to mind. The RM did not bat an eyelid. May be he was accustomed to investors asking for repeats of his story about guaranteed-NAV Ulips. Say a lie a thousand times to make it true.

“Of course. This plan is a 10-year unitlinked insurance plan which guarantees the highest NAV during the first seven years of the policy. You invest at the rate of Rs 10 per unit. Say, after five years, the NAV of one unit is Rs 35—the highest it reaches in the policy’s term. But by the time of maturity, the NAV has fallen to Rs 28. Nevertheless, your returns will be calculated at the rate of Rs 35 per unit. It is a win-win situation,” said the RM.

It certainly seemed so, the way he put it. The RM’s final push was subtle: “So the insurance company offers the best of three options: the highest NAV of the first seven years, the NAV at maturity or Rs 10 per unit." What he did not say: “The policy goes all out to ensure the best for you. You can’t get a better deal.” How generous of the insurance companies. One would think they are a non-profit organisation, doling out the best returns for every investor.

“Ulips invest in the stock market which goes up and down everyday. So how can they guarantee returns by investing in something so volatile?” I asked, wanting to gauge whether the RM knew how the ‘guaranteed returns’ were fixed. “This is why you should invest in it. It is what makes this Ulip special,” he replied. I probed further: “Let’s say the guaranteed-NAV policy raises Rs 1,000 crore across India. The money is invested in the stock market.

As per your example, five years later, the NAV touches Rs 35. This means the Rs 1,000 crore has grown to Rs 3,500 crore. But at the end of 10 years, when the NAV is Rs 28, the corpus is only Rs 2,800 crore. How can the company pay Rs 700 crore extra when it doesn't have the money?”

For a better perspective, I added: “And what if there is a crash in the markets and the NAV drops to Rs 15 at maturity? Then the insurer will have a corpus of Rs 1,500 crore but need to cough up Rs 3,500 crore.” The RM stared at me. The unassuming investor had metamorphosed into an aggressive, number-talking demon. One thing was certain, he did not know how the highest NAV of the Ulips are fixed. It wasn’t a surprise.

Insurers are cagey about the math behind the guarantee. The trick is to gradually switch investments from equities to debt. The Ulips start out with maximum exposure to equities. As the date of maturity nears, the proportion of debt investments goes up. This is done by regularly booking profits from equities and transferring them to safe havens, ensuring that the NAV does not breach a predetermined level. Any loss due to the guaranteed returns is minimal.

You get the highest NAV of the policy, but it is not the same as the highest level of the market. For some moments, I toyed with the idea of explaining the concept to the RM. Then I realised it would do no good. A fresher from a B-school, he had been taught to sell, not to understand how a product is constructed.

His next remark confirmed my opinion: “I don't know the answer to your question. But if you leave your number, I will check and revert. Meanwhile, take the product brochure and the application form.” The bank had trained him well. The mask of the perfect salesman was back. Not needing an excuse any more, I got up and left the bank.

6 MUST KNOWS ABOUT GUARANTEED NAV

No instrument that invests In equities can guarantee returns.

The Securities and Exchange Board of India does not allow even mutual funds to guarantee returns.

The highest NAV is not the same as the highest level of market during the policy's tenure.

There is no minimum return guaranteed by the policies.

The insurance companies do not explain how they manage to deliver the guaranteed returns without incurring losses.

There are more transparent equity instruments, such as mutual funds, which offer exposure to stocks.

UTI Mutual Fund: When guaranteed returns went bust

A few years ago, the Unit Trust of India (UTI) had around Rs 17,000 crore invested in its assured return schemes. All these schemes had to be shut down in 2002 when things started to go haywire. So, be on your guard when you hear guaranteed and equities together.

Want to read more on about the 'TRUE' nature of Guranteed ULIP's, Click the links below:

Best to stay away from guaranteed NAV plans

Investors with highest NAV guaranteed ULIPS lured

The trap called guaranteed NAV

Showing posts with label Insurance. Show all posts

Showing posts with label Insurance. Show all posts

Wednesday, December 29, 2010

Thursday, March 4, 2010

Mediclaim Cos cannot fool clients by playing with words: Court

Wed, Mar 3 12:50 PM

"The death of a portion of heart muscle as a result of inadequate blood supply as evidenced by an episode of typical chest pain, new ectrocardiaographic changes and by elevation of the cardiac enzymes. Diagnosis must be confirmed by a consultant physician."

This is not the description of a heart disease in a medical journal but definition of the now common heart attack in the policy of a prominent life insurance company. When St Stephen's Hospital handed A.K. Jain a bill of Rs 1.91 lakh after heart surgery, he remained cool. He expected full reimbursement from his mediclaim policy with ICICI Prudential Life Insurance. He had suffered a heart attack on November 11, 2007. A stent was placed in the veins to regularize blood flow.

To his shock, the company declined to pay, saying "his disease did not correspond to the symptoms laid down in the insurance cover". It was pointed out "no muscle of heart became dead" and "no elevation of enzymes was noted ", and "no changes were found in the ECG".

Not ready to take the injustice lying down, Jain moved the consumer court. Two-and-half years later, on Tuesday, Jain got justice with the Delhi State Consumer Commission asking ICICI to reimburse full amount and a compensation of Rs 8,000. The panel termed ICICI's definition of 'heart attack' as laying down of rare symptoms deliberately to deny reimbursement.

In a message to all companies, the panel headed by Justice Barkat Ali Zaidi said “it is not open to a insurance company to insist on symptoms and details which often do not appear to escape payment of compensation. It amounts to defrauding and cheating the customer".

Countering ICICI's argument that Jain had signed the document with their conditions, the panel said such minute details are generally glossed over and citing them to deny payment was "fraud and deception".

"The spirit of the agreement (between the company and policy holder) must be assumed to be such as to provide relief in case of any heart disease."

Read original article at: http://in.news.yahoo.com/32/20100303/1053/tnl-mediclaim-cos-cannot-fool-clients-by_1.html

"The death of a portion of heart muscle as a result of inadequate blood supply as evidenced by an episode of typical chest pain, new ectrocardiaographic changes and by elevation of the cardiac enzymes. Diagnosis must be confirmed by a consultant physician."

This is not the description of a heart disease in a medical journal but definition of the now common heart attack in the policy of a prominent life insurance company. When St Stephen's Hospital handed A.K. Jain a bill of Rs 1.91 lakh after heart surgery, he remained cool. He expected full reimbursement from his mediclaim policy with ICICI Prudential Life Insurance. He had suffered a heart attack on November 11, 2007. A stent was placed in the veins to regularize blood flow.

To his shock, the company declined to pay, saying "his disease did not correspond to the symptoms laid down in the insurance cover". It was pointed out "no muscle of heart became dead" and "no elevation of enzymes was noted ", and "no changes were found in the ECG".

Not ready to take the injustice lying down, Jain moved the consumer court. Two-and-half years later, on Tuesday, Jain got justice with the Delhi State Consumer Commission asking ICICI to reimburse full amount and a compensation of Rs 8,000. The panel termed ICICI's definition of 'heart attack' as laying down of rare symptoms deliberately to deny reimbursement.

In a message to all companies, the panel headed by Justice Barkat Ali Zaidi said “it is not open to a insurance company to insist on symptoms and details which often do not appear to escape payment of compensation. It amounts to defrauding and cheating the customer".

Countering ICICI's argument that Jain had signed the document with their conditions, the panel said such minute details are generally glossed over and citing them to deny payment was "fraud and deception".

"The spirit of the agreement (between the company and policy holder) must be assumed to be such as to provide relief in case of any heart disease."

Read original article at: http://in.news.yahoo.com/32/20100303/1053/tnl-mediclaim-cos-cannot-fool-clients-by_1.html

Thursday, February 25, 2010

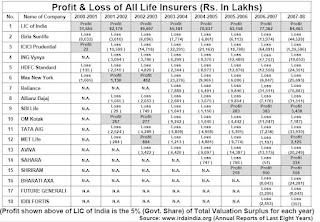

Financial Health of Life Insurance Companies in India

Hardcore marketing by Insurance companies and their agents are a common sight in India. Rarely investors wonder if the insurance companies in which they invest in are financially healthy. At the end, all the multicolour returns that these companies stress as returns depends on the profitability of the companies as such.

Hence we are publishing herewith an article that appeared some time back in April 2009. Do read the Original report below and verify the attached file.

Life insurers' losses soar 43% in FY09

The Insurance Regulatory and Development Authority (Irda) on Wednesday said the life insurance industry reported a total loss of Rs 4,878.49 crore at the end of March 2009. This is about 43% higher than the previous year's total loss of Rs 3,412.81 crore.

Out of 22 life insures, only four have reported profits. They are LIC, Kotak Mahindra, Met Life and Shriram. LIC has reported an increased profit of Rs 957.35 crore as against the previous year's profit of Rs.844.63 crore. Kotak Mahindra, for the first time, has reported a net profit of Rs 14.34 crore. During the previous year, the company had incurred a loss of Rs 71.87 crore. Met Life and Shriram have reported a net profit of Rs 14.52 crore and Rs 8.11 crore, respectively.

ICICI Prudential, the largest private sector life insurer, reported losses for the eighth consecutive years. The company, which reported a loss of Rs 1395.06 crore in 2007-08, has recorded a loss of Rs 779.70 crore in 2008-09. During the year under review, the net losses of 12 companies have gone up as compared to the previous year.

Four new life insurance companies came into existence during the year. Among them, except Aegon Religare, other companies—Canara HSBC, DLF Pramerica and Star Union Dai-ichi—have reported losses.

Irda has explained that life insurance industry is capital intensive, and insurers are required to inject capital at frequent intervals to achieve growth in premium income. Given the high rate of commissions payable in the first year, expenses towards setting up operations, training costs for developing the agency force, creating a niche market for its products, achieving reasonable levels of persistency, providing for policy liabilities and maintaining the solvency margin, would be difficult for the insurers to earn profits in the initial seven to 10 years of their operations.

Meanwhile, the life insurance companies have settled 6.05 lakh claims on individual policies, with a total payout of Rs 4,798.22 crore. The number of claims repudiated was 12,781 for an amount of Rs 179.59 crore. The number of claims pending at the year end was at 16,915 and the amount involved was Rs 242.84 crore. Of these claims, 2,574 were pending for more than one year and 2,875 claims were pending for more than six months but less than one year.

Also LIC's investment income including capital gains was lower at Rs 43,122.17 crore in 2008-09 compared to Rs 56,672.91 crore in 2007-08. As a percentage of total income, it declined by 23.91% in 2008-09 from an increase of 37.78 % in 2007-08.

As against this, the share of investment income to the total income for the private life insurers declined by 336.81% in 2008-09 (as against an increase of 23.37% in 2007-08). Companies have also reported an improvement in the yields on their investments. The industry is still in the process of stabilising and despite additional contributions by way of share capital, it would require time to reach the consolidation stage.

Sunday, March 15, 2009

Invest with Gurantee to Sell at Highest Price

Invest With Gurantee to Sell at Highest Price:

(For Investors who want the Best Returns without the Risk of Losing Selling Opportunities at Higher Prices.)

The last stock rally that started in 2003 and ended up in Jan 2008 was more like a dream run. Anyone who had invested Rs.1,00,000 in 2003 would have made 300% to 400% by simply staying invested. But many do regret for having not sold at the peak price and feel having missed out a golden selling opportunities. Though the loss is realized only if booked at the current levels, many investors would have been contented if they were able to "freeze" the highest price with the provision to continue staying invested in Stocks/mutual funds.

SBI Life, a wholly owned subsidary of State Bank of India has come out with an innovative investment avenue where in investment need to be made for the three years in a row. After that, the client is free to redeem/close the investment at the prevailing market price. Meanwhile, if the investor miss out selling at higher price (just like the one that happened when market rallied from 4000 points in June 2003 to 21000 points in Jan 2008), the client needs to wait for 10 years when all the units will be redeemed at the highest NAV recorded in the first seven years of the scheme. Inbetween the client is free to sell in part/full of all his investments if it is favourable or desired by his.

At EASY Investment we back-tested this concept as per the the table annexed. (Do have a close look a the table).

The inference of the study are:

- The Investment was assumed to have stated in 1999. Hence the highest NAV in the first 7 years was Rs.26.62.

- But onthe 9th Year the markets did peak out (Jan 2008). The NAV then was Rs.59. The investor could have sold at this peak price. IF Greed was the problem, they he/she would have waited for much higher price.

- Meanwhile markets crashed. In the last 14 months, the NAV crashed down to about Rs.23 (as on 4th March 2009).

- Though the prevailing NAV is lower, the highest NAV in the first 7 years - Rs.26.62 is taken as the final NAV for redemption. Had the NAV on the 10th year been better than Rs.26.62, then that NAV would be accounted for redemption.

Ultimately investors stand to gain in this volatile uncertain market conditions. It is like investing in equity with a Safety net to sell at the highest NAV on maturity.

To know more about this concept, do email us at invest@easymadurai.com or call us at 9944193339.

BusinessLine has analysed this product in the below mentioned link: http://www.thehindubusinessline.com/iw/2009/03/15/stories/2009031550631400.htm

Subscribe to:

Posts (Atom)