Volatility is the inherent nature of stock market - whether we like it or not. But the kind of swings we are witnessing in 2022 could embolden any investor to venture into stock market investing.

In hindsight it look easier to Buy Low and Sell High. But in reality each fall comes wish lots of negative news and each rise comes with host of positive news. A typical investor remains positive and optimistic when these negative news are floating around and remains negative when positive news gets built up. As a result precise entry-exit is easier said than done.

Many investors - particularly the new age / new generation investors - find this 'predictability' interesting and impressive. It has made them believe that making money is easy in stock market. As a result many got lured to equity investing - by opening record number of demat accounts in past two years. But in reality such 'V' shaped recovery - which typically happens over short term- could spoil the true sprit of equity investing. Infact, it has set the expectations wrong among budding investors.

Many of them have not seen bear markets which have lasted for more than 2 years - like in 2001- 2004 Tech bubble / WTC Collapse or Global Financial Crisis in 2007- 2009. The drawdown in each of these factors have been for more than 50%!.

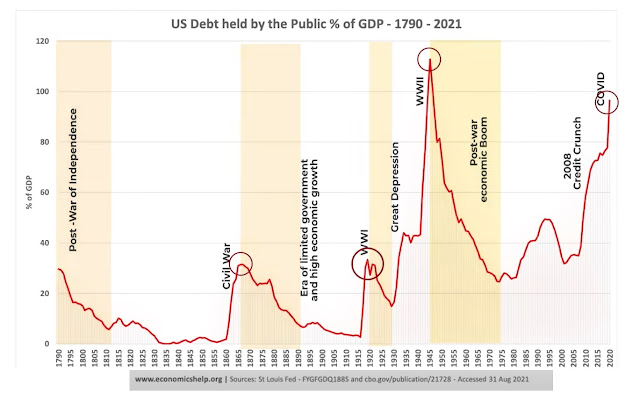

While geopolical risks are common and has been happening every alternate hear, the debt market bubble and higher inflation are rare occurrences. Infact since 1790 - the debt market crisis has happened only 4 times in the past and each one has been followed by a long recession. According to Mr. Ray Dalio, American Hedge fund manager and author of 'Changing World Order, we are starring at the 4th such drawdown now.

Infact, when debt markets collapse, there would be sell off's across asset classes - be it equity, debt etc. The only safe haven could be physical assets like real estate and precious metals like Gold.While we try to learn from history and avoid disasters, it is the over reaction that creates newer problems. As a result, it is always wiser for investors to remain cautious and not put all eggs in one basket. It is like a musical chair - no one knows when the music will stop. Having an asset allocation across assets could be the best way to ride the tide - cautiously.

No comments:

Post a Comment